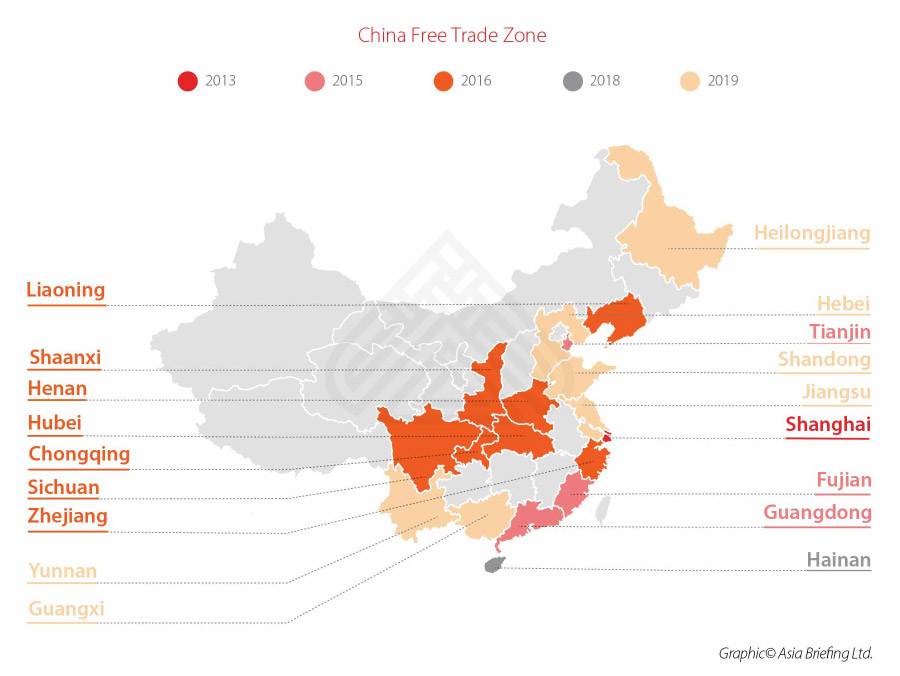

At 10:00 a.m. today (August 27, 2025), the State Council Information Office of China held a press conference. Kong Dejun, Director-General of the Department of Trade in Services at the Ministry of Commerce (hereinafter referred to as “Kong”), stated that relevant authorities have introduced a series of liberalization measures in pilot free trade zones (FTZs) and the Hainan Free Trade Port. These measures cover areas such as professional qualifications for individuals, professional services, finance, and culture, thereby proactively expanding market access for services. According to Kong, these initiatives have already been rolled out in an orderly manner and have produced tangible results.

For instance, in FTZs located in Guangdong, Shanghai, Fujian, and Zhejiang, foreign nationals are now allowed to sit for professional qualification exams such as Registered Urban and Rural Planner, Real Estate Appraiser, Supervising Engineer, and Registered Survey and Design Engineer. In addition, foreign nationals are permitted to open securities or futures accounts within FTZs to engage in securities investment consulting and futures trading consulting.

Kong further explained that in March 2024, with the approval of the Central Committee of the Communist Party of China and the State Council, the Ministry of Commerce issued the Special Administrative Measures for Cross-Border Trade in Services and the Special Administrative Measures for Cross-Border Trade in Services in Free Trade Zones. These established a nationwide negative list management system and a phased liberalization framework for cross-border trade in services.

“The implementation of a negative list for cross-border trade in services has significantly improved transparency and predictability, laying a solid foundation for creating a transparent, stable, and predictable institutional environment,” Kong said.

For a long time, China’s capital market has imposed strict restrictions on foreign participation. Previously, overseas individuals or institutions could only invest in A-shares through channels such as QFII (Qualified Foreign Institutional Investor), RQFII, or the Shanghai-Hong Kong and Shenzhen-Hong Kong Stock Connect programs—channels that involved high entry thresholds and cumbersome procedures.

Allowing foreign nationals to open securities accounts directly in FTZs means that overseas individual investors no longer need to rely on complex channels, granting them easier access to China’s domestic capital market.

This new policy lowers investment barriers for foreigners in China. Moreover, foreign capital can now directly invest in China’s capital market in RMB through FTZ accounts, enhancing the attractiveness of RMB-denominated assets and advancing the international use of the Chinese currency.

In short: permitting foreign nationals to open securities accounts in China’s FTZs marks the first time the country’s capital market has directly opened its doors to overseas individual investors—an important step in RMB internationalization, capital market liberalization, and financial reform in free trade zones.